“Life is a tight rope between two errors….” is an excerpt from the writings of a prominent author Nassim N Taleb. We simply believe this applies to investment also as we can say the investment is a tight rope between two fears, i.e. fear of missing out and fear of being invested. As we have both the fears of losing the opportunity of wealth creation as well as the probability of wealth destruction, this always leads to confusion and drives our behavior and approach towards Investments.

Somewhere we have to accept that some amount of fear/confusion stabilizes the decision process, otherwise either fear or greed could take over. Well, one can argue that having emotion or fear towards market fluctuations is obvious, to which we completely agree but also believe that we can overcome this.

Investment is an outcome of a well-structured process backed by a holistic approach towards individual life goals & events having defined timelines. The intermediate volatility or uncertain market movements should not materially impact our investment decisions, once we tag them to our financial goals. Because our actions as a fallout of the fear factors in turbulent times prove unhealthy for our financial health. Let’s do some data crunching to see whether the numbers validate this observation or not because as rightly said, ultimately what data says is important.

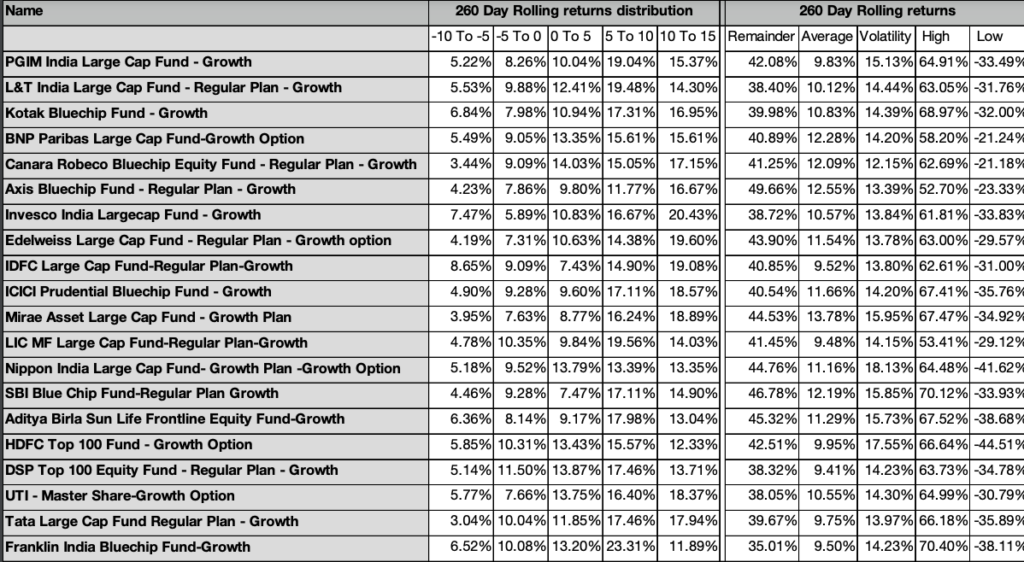

Rolling Returns Distribution & Averages of Large Cap MF Category

* Data Compilation Source – NGEN & Morning Star Advisor Work Station

The selection of data has been taken from a large-cap universe of mutual fund schemes with a history of more than ten years. The backtesting takes into account a Ten years investment horizon with a Daily rolling frequency & a holding period of one year (260 trading days).

Data shows how important it is to hold on to your nerves, as the end result despite the volatile swings is a respectable one.

So, the point is how to overcome this volatility in our emotions as we can’t control the volatility in the market. Is it only the investor, who has to face this dilemma; the answer is NO. Let’s take an example, we all know M.S.Dhoni whom not only we Indians but also the world respects as a calm, collective, and successful leader. As a market participant, Dhoni would have been one of the most successful, because he has that key ability required, we have almost never seen him getting carried away by the situation in the match. Planning, process, strategy everything is done before and the match is for execution only. This is exactly what is required by us, our plan, goals, process, strategy, everything should be done beforehand and then our focus should be on the execution rather than prediction. Because unlike Cricket, where in spite of all plans & strategies, the outcome still remains 50-50, for us in investment if we follow the process our probability of winning is 100%. This is a quite simple yet proven fact, so the choice is ours.

We know that we are in a global crisis, times are most uncertain in totality. Still, we have to hold on and believe in. Key is to work towards bridging the behavioral gap & match the Investor returns to the investment returns which is aptly rewarding.

Stay Calm… Stay Safe…. Stay Invested.

Happy Investing!

Team @ MintBox Advisory

DISCLAIMER: PLEASE NOTE, THE ABOVE NOTE IS FOR INFORMATION PURPOSES ONLY AND SHOULD NOT BE CONSTRUED AS INVESTMENT, TAXATION, AND/OR LEGAL ADVICE. MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME-RELATED DOCUMENTS CAREFULLY.

Mutual fund investments or Investment in securities market are subject to market risks. Please read the scheme information and other related documents carefully before investing. Past performance is not indicative of future returns.