Ever since the Evolution, the ONE SINGLE thought or phenomenon which differentiated us humans from the rest of the biological species was to think BEYOND what’s available. Yes, and that’s why Agriculture rather than Internet could well be termed as the most important invention made by mankind, as that made us hungry for more. The idea of putting across things we have in a particular fashion so that we get something extra out of it or the expectation of a result from our actions, is what we term as RETURNS today.

So, what’s this all about – Actually from being hungrier to bounded rationality, the one thing or one desire that has driven our actions is returns. And when it comes to our moves in finance the ‘x’ factor of return gets amplified to the highest volume, as the menu of returns got bigger. It is no surprise, that we place the highest focus on the outcome or returns and often fail to recognize the fact that it is a function of many important aspects & depends on a calibrated process which involves a defined set of steps & principles. To put it simply, the difference between your investment & its market value at a specific point is the return on it – Positive or Negative.

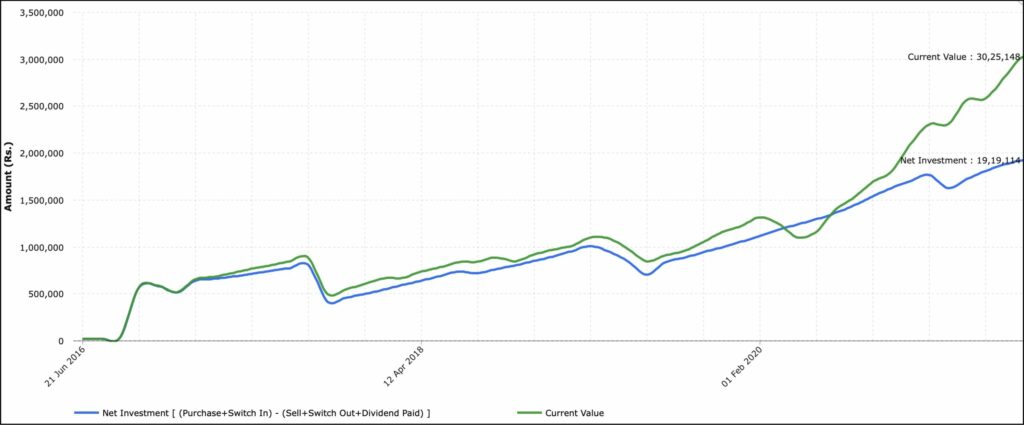

This graph presents the terminology in a simple way, wherein as we can see the BLUE line indicates the investment amount and the GREEN one is the market value. Anything above or below the BLUE line is return: positive or negative

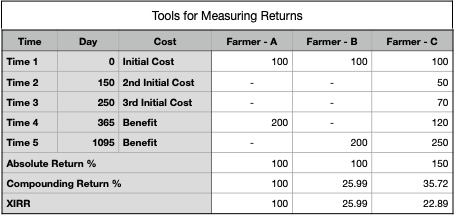

This is telling only returns made, but how much, how to measure? Broadly four major statistical tools are available to measure the Returns – Absolute, Compounding, IRR and XIRR. Let us now try to understand the measurement of returns with the help of a simple example. Farmer Mr. A when asked about his produce states that he started working in the month of May spending X amount and harvested by next May getting X+100, then 100 is his profit or return. This is the most basic expression of Returns & is also known as ABSOLUTE RETURN. We now meet farmer Mr. B who started with the same amount X in January & got back X+100 after 3 years. Here, Mr. B also made Rs. 100

& we can say they both got the same returns. As we can see, absolute return doesn’t consider time spent to earn it & hence is not helpful in comparing the various available options.

Coming back to our case, if we give both Mr. A & B the same amount of money to be spent on farming for 1 year each & check their profits thereafter, we can know their true profitability. Whenever a return is represented on an Annual basis, it is known as CAGR or Compounded Annual Growth Rate. This is the most widely used expression of returns but has its own limitations as it ignores intermediate cashflows, evens out the entire duration & gives an average return over it.

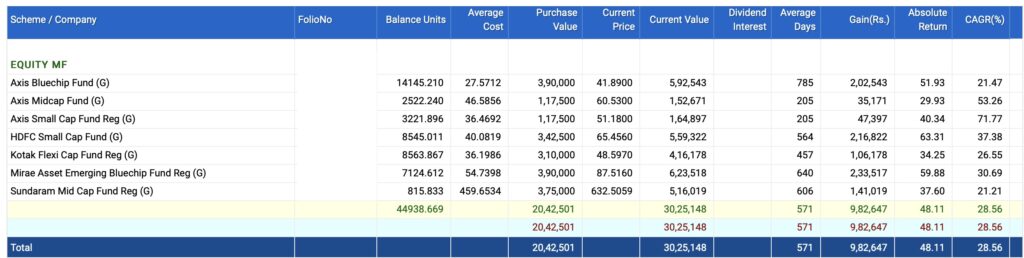

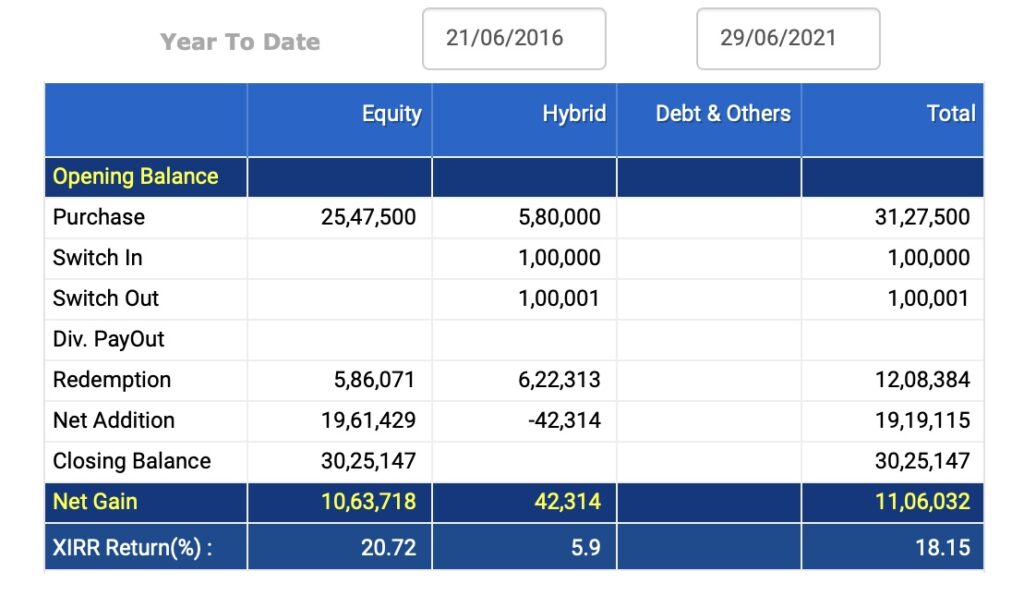

A look at farmer Mr. C shows that he has put in & also taken out varied sums of money at different times during the period under consideration, which is why earlier tools like Absolute & CAGR may not depict the true picture. Internal Rate of Return or IRR becomes handy as it considers intermediate cashflows of uniform amounts at equal intervals while measuring the returns. The extended version of IRR which is the XIRR is used to determine the returns in case of uneven cashflows at irregular intervals. The following tables display various returns of a sample mutual fund portfolio (randomly picked actual data) :

Table A shows the returns on a portfolio, both Absolute & CAGR. It may be noted that the calculations are all based on the currently held portfolio and it does not reflect the profit or loss on account of intermediate purchases, switches, and redemptions during the investment journey. Data in Table B reflects the XIRR of the same portfolio after considering the intermediate investments, withdrawals, etc.

We discussed the various tools to measure returns on an investment (single or portfolio) and their respective limitations. While Absolute return ignores the time factor, CAGR fails to consider the intermediate cash flows during the investment journey. Internal Rate of Return takes into account equivalent cash flows at regular intervals & XIRR is helpful when there are uneven or irregular in or outflows. The application of these tools to understand investment performance, their usage in various empirical studies would be covered in the next edition of “DECODING RETURNS”.

Where do returns come from? What impacts them? How to rationalize returns? The answers to these and more such questions leave us to the conclusion that if we stick to the process with discipline in action, we may or may not become great investors but our investments will surely harvest great returns.

Happy Investing!

Team @ MintBox Advisory

DISCLAIMER: PLEASE NOTE, THE ABOVE NOTE IS FOR INFORMATION PURPOSES ONLY AND SHOULD NOT BE CONSTRUED AS INVESTMENT, TAXATION, AND/OR LEGAL ADVICE. MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME-RELATED DOCUMENTS CAREFULLY.

Mutual fund investments or Investments in the securities market are subject to market risks. Please read the scheme information and other related documents carefully before investing. Past performance is not indicative of future returns.